Oilseed Rape market

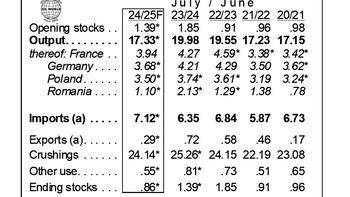

The prospective recovery in world supplies of rapeseed & canola may turn out smaller than initially expected, pushing new-crop prices higher. This is primarily true in the three major exporting countries, viz. Canada, Australia and Ukraine, where smaller plantings and below-average yields (primarily Ukrai...

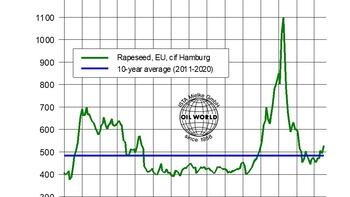

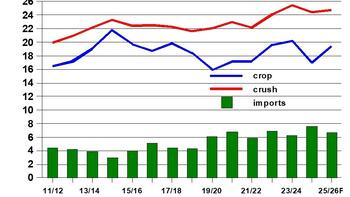

Seasonally declining supplies in the key producing countries as well as weather conditions and the pace of canola plantings in Canada and Australia for the 2025 crop, and geopolitical developments will be key price-determining factors in coming weeks, also affecting European rapeseed prices. The global rapese...

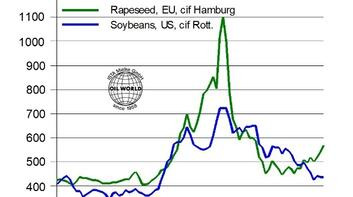

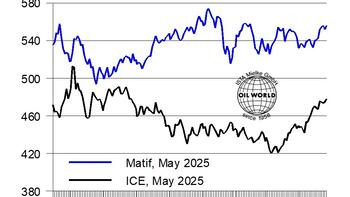

Diverging fundamentals in the two major markets, viz. the EU and Canada, have significantly widened the spread between genetically modified canola and non-GM rapeseed in March. Diminishing domestic supplies, primarily for crushers in Central Europe, pushed EU rapeseed prices higher so far this week. Nearby ra...

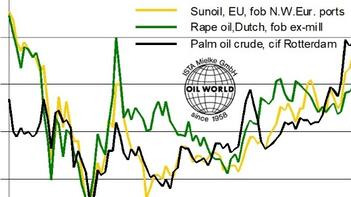

Diminishing supplies in the key producing countries as well as appreciating vegetable oil prices have pushed rapeseed & canola prices higher in the week to Feb 21, with Canadian canola prices on the ICE reaching a 7-month high of CAN-$ 680.10 in the May position on Feb 20. EU rapeseed prices followed the ...

Update prepared by ISTA Mielke GmbH – Global Oil World analyses and forecasts for oilseeds, oils & fats and oilmeals in Hamburg, Germany. On www.oilworld.de more details are provided about the company profile and th...