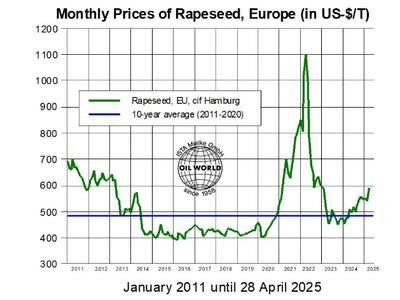

Seasonally declining supplies in the key producing countries as well as weather conditions and the pace of canola plantings in Canada and Australia for the 2025 crop, and geopolitical developments will be key price-determining factors in coming weeks, also affecting European rapeseed prices. The global rapeseed market is currently in transition from relatively tight old-crop supplies to a more ample situation in 2025/26.

Ongoing large Canadian exports as well as appreciating US soya oil prices pushed Canadian canola prices higher in the second half of April. Old-crop prices on the ICE (May position) closed at CAN-$ 694.80 on April 28, up 5% within two weeks. European rapeseed prices increased by 2.0% since April 14 on the Matif and only 1% in US dollar equivalent, curbed by the weakness of the US dollar.

Following the widening of the price premium of EU rapeseed vis-a-vis the world market, EU crushers have reportedly stepped up purchases of Canadian canola. Diminishing sunflowerseed and oil supplies have reportedly also led to a shift of processing capacity to rapeseed. This is particularly true in Bulgaria, where imports and processing of Canadian canola are seen increasing sharply in Apr/June 2025.

OIL WORLD estimates EU-27 imports of rapeseed & canola to reach a new high of 7.42 Mn T in July/June 2024/25 (vs. 6.18 Mn T a year earlier), while crushings are seen plummeting by 1.2-1.3 Mn T (all of which in Jan/June 2025). Soaring import demand from the EU and China is seen boosting the global trade volume of rapeseed & canola to a record 20 Mn T in 2024/25, implying an increase of roughly 2.0 Mn T from a year earlier. Reduced domestic supplies in Ukraine and Australia will curb combined shipments from these two major exporting countries by an estimated 1.3 Mn T in July/June 2024/25, raising the dependence on Canadian canola.

Firmness in prices of the major seed oils contrasted with a sizable setback in palm oil in recent weeks. Comparatively high prices have triggered significant demand rationing in Oct/March 2024/25, required by the pronounced slowdown of the production growth. In the full season OIL WORLD currently expects world production of the eight major oils to increase by only 1.6 Mn T, down from 5.0 Mn T in 2023/24.

Poor price competitiveness is curbing production and usage of biodiesel sizably below potential this season in the European Union, Argentina, Brazil, Indonesia, Malaysia, India, China and other countries. These developments have affected rapeseed oil prices in the EU, limiting the increase in rapeseed prices despite the relatively tight old-crop supplies.

Update prepared by ISTA Mielke GmbH – Global Oil World analyses and forecasts for oilseeds, oils & fats and oilmeals in Hamburg, Germany. On www.oilworld.de more details are provided about the company profile and the individual services.