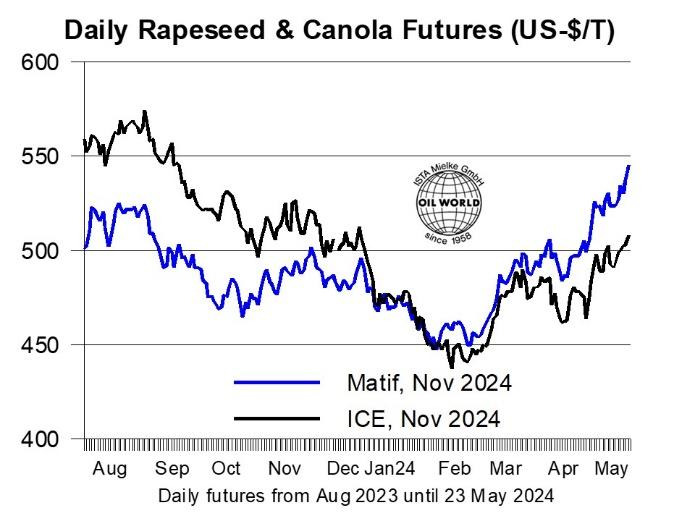

European new-crop rapeseed prices exceeded EUR 500 on the MATIF on May 23, closing at EUR 502.75 in the Nov position. Strength of the euro vis-a-vis the US dollar pushed the EU rapeseed price to US-$ 545, up 8% in three weeks and the highest level since July 2023.

The prospective tightening of world export supplies of rapeseed & canola in 2024/25 and the growing dependence on Canadian canola will require additional independent price strength in Europe in order to facilitate the required increase in imports. European rapeseed prices closed at a premium of US-$ 38 vis-a-vis Canadian canola at the close of May 23, up from only $ 16 a month ago but still too low to cover import costs.EU rapeseed imports will have to rise to an estimated 6.9 Mn T in July/June 2024/25 to mitigate the severe decline in domestic supplies. This compares to arrivals of 5.7-5.8 Mn T shaping up in the current season. However, the exportable surplus in Ukraine and Australia, together supplying 6.0 Mn T or 88% of the total in 2022/23, will be much smaller next season, forcing European crushers to step up purchases of Canadian canola.

Australian canola supplies are likely to plummet by around 1.0 Mn T to a 4-year low of an estimated 5.4 Mn T in 2024/25. Dryness has reportedly reduced sowings in Western Australia below initial estimates. Supplies in 2024/25 will be additionally curbed by lower old-crop stocks in early Oct. Latest OIL WORLD estimates also point to lower Ukrainian export supplies in 2024/25. Reduced plantings and the risk of below-average yields due to lower inputs for the second consecutive season are likely to reduce the exportable surplus by around 0.3 Mn T.

Recent rains have significantly improved Canadian canola production prospects. This year’s crop is expected o reach around 20.3 Mn T (vs. 18.3 Mn T in 2023), setting the stage for a sizeable increase in disposals next season. While the current Canadian production outlook is good news from a world market’s perspective, farmer selling will be a crucial swing factor to watch in coming months as a relative price adjustment will be required in order to revive world import demand for Canadian canola.

The surplus of vegetable oils registered on the world market during the past two seasons is giving way to tightening supplies in 2023/24. Oil WORLD expects supplies to tighten in April/Sept 2024 when world production of eight oils is forecast to increase by only 2.1 Mn T, versus 3.2 Mn T in Oct/March 2023/24. Rapeseed oil prices in Rotterdam rallied to more than US-$ 1100 on May 23, up 5% in the past two weeks and the highest level in 10 months. Seasonally declining rapeseed crushings as well as the outlook of tighter supplies next season appear to be already impacting market sentiment and prices in the nearby.

Update prepared by ISTA Mielke GmbH – Global Oil World analyses and forecasts for oilseeds, oils & fats and oilmeals in Hamburg, Germany. On www.oilworld.de more details are provided about the company profile and the individual services.