Market Update for Rapeseed & Canola 5th of Sept. 2024

Lower than initially expected production and smaller stocks carried into the new season are likely to reduce world supplies of rapeseed and canola by an estimated 5.0 Mn T in 2024/25, making demand rationing inevitable even under the assumption of a further sizeable setback in stocks.

Word production is now estimated to drop by 3.2 Mn T to a three-year low of 76.2 Mn T this season, with sizeable year on year declines in the EU 27, India and Ukraine only partly offset by increases in Russia and Canada.

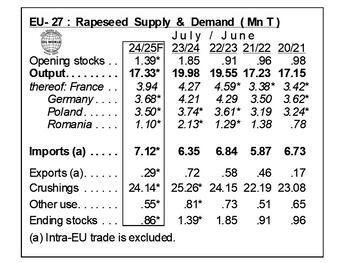

Winter rapeseed plantings as well as lower yields have slashed this year's EU rapeseed crop to only 17.3 Mn T, down 2.7 Mn T from a year earlier. Reduced stocks as of end July will widen the decline in domestic rapeseed supplies in the EU by 3.1 Mn T in 2024/25. OIL WORLD estimates EU imports of rapeseed to reach a record of at least 7.1 Mn T in July/June 2024/25 while crushings are forecast to decline by 1.1 Mn T.

The threat of Chinese import restrictions on Canadian canola has added an additional risk to the already volatile global supply and demand outlook for rapeseed & canola in 2024/25. Chinese authorities have reportedly initiated an antidumping probe into canola imports from Canada in response to Canadian restrictions on Chinese electric vehicles last week.

During the last trade conflict, which started in early 2019, China blocked canola imports from the two largest Canadian exporters, while shipments of canola oil and meal were not affected. The extent of the new restrictions as well as the products involved will thus be major swing factors to watch. During the previous conflict, China stepped up imports of canola oil and meal to at least partly offset a shortage on the domestic market.

How will global trade flows change in case of Chinese import restrictions on Canadian canola? We expect that China will step up imports of Russian rapeseed in 2024/25, promoted by this year’s record Russian crop of at least 4.9 Mn T (up 0.7 Mn T from a year earlier) and prohibitively high EU import duties on Russian oilseeds and products, which are likely to keep rapeseed crushings in Russia (primarily at plants located at the Baltic Sea) below potential. We would also not be surprised if Chinese import restrictions on Canadian canola coincide with a lifting of the non-tariff trade barriers on Australian canola, forcing other importing countries such as Japan, the UAE and Mexico to again cover most of their requirements in Canada. Especially the UAE already emerged as an indirect “trading hub” for Canadian canola to China by importing the seed and exporting the products during the last trade conflict.