Market Update for Rapeseed & Canola 7th of Oct. 2024

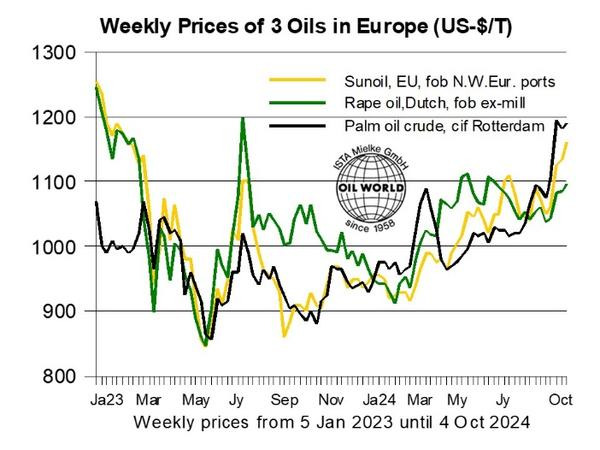

Rapeseed prices have recovered pronouncedly in September and there are fundamental reasons behind it. A tightening of global vegetable oil supplies and demand-rationing will be inevitable in the season 2024/25. Combined world production of sunflower oil and rapeseed oil is currently estimated to decline by 3.7 Mn T on the year in 2024/25. In contrast, world soybean supplies will be ample this season, assuming that much-needed rainfall in South America will arrive in time. If the OIL WORLD estimate of an increase by 14 Mn T in the southern hemisphere materializes, world production of soybeans is likely to increase by 28.2 Mn T to 421.9 Mn T in the world crop season 2024/25.

However, the production of soybean oil cannot be increased sufficiently. The supply of palm oil remains relatively scarce. Global exports of vegetable oil will continue to decline in 2024/25.

The fundamentals of the global rapeseed oil market are set to change in 2024/25. Following the combined increase of 5.7 Mn T or 22% in the past two seasons, world rapeseed oil output is seen declining by an estimated 1.3 Mn T in Oct/Sept 2024/25, making demand-rationing inevitable. Trade restrictions on imports from Russia and Belarus as well as lower Ukrainian rapeseed crushings will make it quite challenging for consumers in the EU to offset insufficient domestic supplies of rapeseed oil with larger imports. This is likely to continue to support EU rapeseed oil and rapeseed prices in the near to medium term.

OIL WORLD estimates world production of rapeseed & canola to decline by 3.1 Mn T to a three-year low of 76.2 Mn T in 2024/25, with the by far largest setback of around 3.0 Mn T in the EU-27. Latest official estimates confirm unusually low yields in key producing regions. Combined rapeseed production in Germany and France plummeted by 0.9 Mn T or 10% this year, with average yields down 6% in both countries.

Detrimental weather conditions resulted in even larger year-on-declines in average rapeseed yields in Estonia (down 21%), the Czech Republic (down 19%) and Latvia (down 14%), according to official data. For Romania we currently work with an average yield of 2.5 T/ha (down 20%), slashing the total for the EU-27 to a multi-year low of only 3.04 T/ha (vs. 3.22 T/ha in 2023).

Insufficient domestic supplies will require record EU imports of rapeseed & canola of at least 7.2 Mn T in July/June 2024/25 (vs. 6.35 Mn T a year earlier). However, demand-rationing will still be inevitable this season. We tentatively peg EU rapeseed crushings at 24.1 Mn T this season, down 1.4 Mn T from a year earlier. This year’s smaller Ukrainian rapeseed crop, estimated to have declined by at least 0.7 Mn T, forcing EU consumers to cover their requirements elsewhere. Ukrainian rapeseed exports are forecast to decline by 0.5 Mn T in July/June 2024/25, while crushings my drop by 0.3 Mn T or 30%, curbing export supplies of rapeseed oil and meal correspondingly.

Update prepared by ISTA Mielke GmbH – Global Oil World analyses and forecasts for oilseeds, oils & fats and oilmeals in Hamburg, Germany. On www.oilworld.de more details are provided about the company profile and the individual services.